Mutual funds have become a popular investment choice for individuals seeking to participate in the stock market and diversify their portfolios. But with so much information available, navigating the world of mutual funds can be overwhelming. This comprehensive guide will equip you with the knowledge and confidence to embark on your mutual fund investment journey.

Understanding Mutual Funds

Imagine a pool of money contributed by various investors, each owning a share (unit) of the pool. This pool is then managed by a professional fund manager who invests it in a variety of stocks, bonds, or other assets, based on the fund’s objective. The value of your units fluctuates based on the performance of the underlying assets.

Benefits of Investing in Mutual Funds

- Diversification: Owning a single mutual fund unit grants you exposure to a basket of assets, significantly reducing risk compared to investing in individual stocks.

- Professional Management: Experienced fund managers handle investment decisions, research, and portfolio rebalancing, saving you time and effort.

- Accessibility: Mutual funds offer lower investment minimums compared to buying individual stocks, making them accessible to a broader range of investors.

- Liquidity: Most mutual funds offer high liquidity, allowing you to redeem your units for cash relatively easily.

Steps to Invest in Mutual Funds:

- Assess Your Risk Tolerance: Before diving in, it’s crucial to understand your risk tolerance. Are you comfortable with potential losses in exchange for higher returns (high-risk, high-reward), or do you prioritize capital preservation (low-risk, moderate returns)?

- Define Your Investment Goals: Are you saving for retirement, a child’s education, or a down payment on a house? Knowing your goals helps determine the investment horizon (timeframe) and suitable fund types.

- Choose Your Investment Platform: You can invest through various platforms, including:

- Directly from fund houses: This offers the widest selection of funds but may require more research and management on your part.

- Online investment platforms: These platforms provide a user-friendly interface and often offer investment guidance and tools.

- Robo-advisors: These automated platforms create and manage personalized investment portfolios based on your goals and risk tolerance.

- Financial advisors: They can provide personalized investment advice and guidance for a fee.

- Select the Right Mutual Funds: Consider factors like:

- Investment objective: Does the fund align with your goals (e.g., growth, income, or balanced)?

- Asset allocation: How is the fund’s money divided between different asset classes (e.g., stocks, bonds, cash)?

- Expense ratio: The annual fee charged by the fund, impacting your long-term returns.

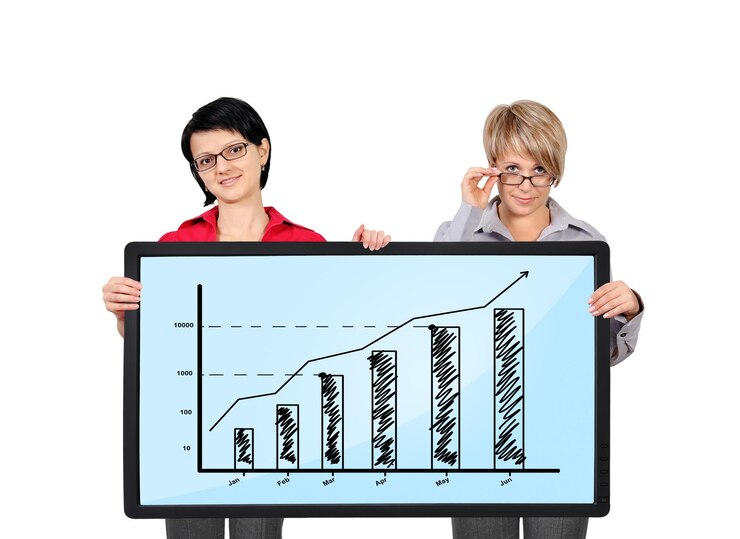

- Past performance: While not a guarantee of future results, historical performance can offer some insights.

- Start Investing: Once you’ve chosen your platform and funds, determine your investment amount and frequency (lump sum or regular installments). Remember, consistency is key to building wealth over time.

Additional Tips for Success

- Do your research: Don’t blindly follow recommendations. Understand the different types of mutual funds, investment strategies, and associated risks.

- Invest for the long term: Mutual funds are best suited for long-term financial goals. Avoid frequent buying and selling, which can incur unnecessary fees and potentially harm your returns.

- Maintain a diversified portfolio: Invest in a variety of funds across different asset classes and sectors to mitigate risk and achieve your financial goals.

- Monitor your investments: Regularly review your portfolio’s performance and rebalance if necessary to maintain your desired asset allocation.

- Seek professional advice: If you’re unsure about any aspect of mutual fund investing, consider consulting a qualified financial advisor.

By following these steps and adopting a disciplined approach, you can leverage the power of mutual funds to achieve your financial aspirations. Remember, investing involves inherent risks, and past performance is not indicative of future results. Always conduct thorough research, understand your risk tolerance, and invest wisely.