The Power of Credit Score in Home Loan Eligibility

In India, your credit score plays a vital role in determining your eligibility for a home loan and the terms offered by lenders. It’s a three-digit numerical representation of your creditworthiness, calculated by credit bureaus like CIBIL. Here’s how your credit score influences your home loan journey:

- Loan Approval: A good credit score significantly increases your chances of getting a home loan approved.

- Interest Rates: Lenders offer lower interest rates to borrowers with high credit scores. This can translate to significant savings over the life of your home loan.

- Loan Amount: A strong credit score may allow you to qualify for a higher loan amount, enabling you to purchase your dream home.

Understanding Minimum Score Requirements

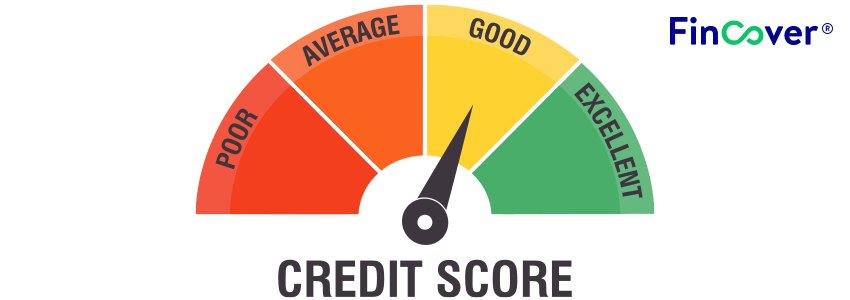

While there’s no universally set minimum credit score for home loans in India, lenders typically have their own benchmarks. Here’s a general guideline:

- Ideal Credit Score (750 and Above): A credit score of 750 or above is considered ideal for securing a home loan with the most favorable terms – fast approvals, competitive interest rates, and potentially higher loan amounts.

- Good Credit Score (700-749): A score in this range can still qualify you for a home loan, but you might encounter slightly higher interest rates or stricter loan approval processes.

- Average Credit Score (650-699): This range may require more scrutiny from lenders. You might face higher interest rates and potentially lower loan amounts.

- Below Average Credit Score (Below 650): Scores below 650 make it challenging to secure a home loan. Approval may be conditional or come with even less favorable terms.

Why Credit Score Matters

A good credit score tells lenders you’re a responsible borrower who manages credit well. This translates into lower risk for them, leading to better loan terms for you. Conversely, a low credit score indicates a higher risk of missed payments or defaults, making lenders wary of offering you a loan or charging higher interest rates to offset the perceived risk.

Factors Affecting Your Credit Score

Several factors influence your credit score, including:

- Repayment History: Consistent on-time payments for credit cards, loans, and other debts significantly improve your score.

- Credit Utilization Ratio: This is the percentage of your credit limit you’re using. Aim to keep it below 30% for a positive impact on your score.

- Credit Mix: Having a healthy mix of secured loans (e.g., car loans) and unsecured loans (e.g., credit cards) can demonstrate responsible credit management.

- Credit Inquiries: Excessive credit inquiries within a short period can negatively impact your score. Apply for loans only when necessary.

Improving Your Credit Score for a Home Loan

If your credit score currently falls below the ideal range for securing a home loan, here’s what you can do:

- Pay Bills on Time: Make timely payments for all your existing debts to demonstrate responsible credit management.

- Reduce Credit Utilization: Pay down your outstanding credit card balances to lower your credit utilization ratio.

- Limit New Credit Inquiries: Avoid applying for multiple loans or credit cards unless absolutely necessary.

- Dispute Errors: Regularly review your credit report for errors and dispute any inaccuracies promptly.

Additional Considerations

- Employment Status: Stable employment history demonstrates consistent income to repay the loan.

- Income Level: Your income level should be sufficient to cover the monthly loan installments comfortably.

- Loan-to-Value (LTV) Ratio: This ratio compares the loan amount to the property value. A lower LTV ratio (meaning you have a larger down payment) reduces risk for lenders and may lead to better terms.

- Property Details: The location, type, and value of the property you intend to purchase can also influence the home loan approval process.

Seeking Professional Guidance

If you’re unsure about your creditworthiness or need assistance navigating the home loan process, consider consulting:

- Financial Advisor: A qualified financial advisor can assess your financial situation, recommend strategies to improve your credit score, and help you choose the right home loan option.

- Loan Officer: A loan officer can guide you through the specific requirements and application process of different lenders.

Conclusion

Understanding credit score requirements and taking proactive steps to improve your score are crucial steps towards securing a home loan and achieving your dream of homeownership. Remember, a good credit score empowers you to access better loan terms, potentially saving you significant money over the long run. By following the tips outlined in this blog and seeking professional guidance when needed, you can navigate the home loan process confidently and pave the way for a secure and fulfilling future in your own home.