Understanding Credit Scores in India

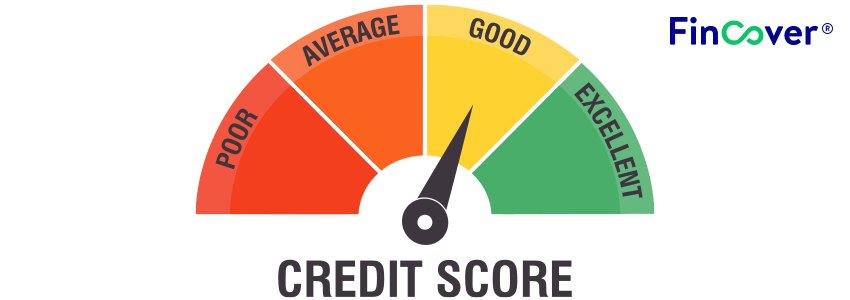

In India, your credit score is a three-digit numerical representation of your creditworthiness, calculated by credit bureaus like CIBIL. It plays a significant role in your financial life, influencing:

- Loan Approvals: A good credit score increases your chances of getting approved for loans, including mortgages, car loans, and personal loans.

- Interest Rates: Lenders offer lower interest rates to borrowers with high credit scores. This can save you a significant amount of money over the loan term.

- Credit Card Applications: A strong credit score makes it easier to get approved for credit cards and potentially qualify for premium cards with better rewards programs.

The Impact of Late Payments

Late payments on your credit card bill can negatively impact your credit score. Here’s how:

- Severity of Impact: The severity of the impact depends on the duration and frequency of the late payment. A single late payment of less than 30 days may have a minimal impact. However, frequent late payments or delays exceeding 30 days will significantly lower your credit score.

- Negative Marks on Credit Report: Late payments are reflected as negative remarks on your credit report, which lenders consider when evaluating your creditworthiness.

- Reduced Credit Score: A lower credit score can make it difficult to qualify for future loans and credit cards, or you may face higher interest rates if approved.

CIBIL Late Payment Penalty

CIBIL, the leading credit bureau in India, considers late payments when calculating your credit score. Here’s a breakdown of the potential impact:

- Late Payment of Less Than 30 Days: A single late payment within this timeframe may have a minimal effect on your score, especially if you have a consistent history of timely payments. However, it’s best to avoid late payments altogether.

- Late Payment of 30-60 Days: A delay exceeding 30 days will likely result in a noticeable drop in your credit score. CIBIL may categorize this as a “severely delinquent” payment.

- Late Payment of More Than 60 Days: Late payments exceeding 60 days can significantly damage your credit score and may be classified as a “default” by CIBIL. This can have severe consequences for your financial well-being.

Beyond the Score

Late payments can also lead to additional consequences beyond impacting your credit score:

- Late Payment Fees: Credit card companies typically charge late payment fees, adding to your financial burden.

- Interest Rate Penalty: Late payments can trigger a penalty interest rate on your outstanding balance, further increasing your debt.

- Difficulty Obtaining Credit: A significantly reduced credit score due to late payments can make it challenging to access credit in the future, impacting your ability to finance major purchases or emergencies.

Strategies to Avoid Late Payments

Here are some tips to ensure you never miss a credit card payment:

- Set Up Automatic Payments: Many credit card issuers offer the option to set up automatic payments. This ensures your minimum payment is deducted automatically from your designated bank account on the due date.

- Use Reminders: Set calendar alerts or reminders on your phone to notify you of upcoming credit card due dates.

- Track Your Spending: Monitor your credit card usage closely to avoid exceeding your credit limit and ensure you have sufficient funds to cover your bill.

- Maintain a Budget: Create a realistic budget that incorporates your credit card payments to avoid overspending and potential late payments.

Recovering from Late Payments

If you’ve already missed a credit card payment, don’t despair. Here’s what you can do:

- Make the Payment Immediately: Pay the outstanding balance and any applicable late fees as soon as possible. Timely resolution shows your commitment to responsible credit management.

- Contact Your Issuer: Explain the situation to your credit card issuer and inquire about any potential late fee waivers or hardship programs they may offer.

- Maintain Timely Payments Moving Forward: Consistent on-time payments over an extended period can help improve your credit score over time.

- Consider Credit Repair Services: For severe cases or difficulty managing multiple credit cards, consider consulting a reputable credit repair service to help you navigate the process of improving your credit score.

Conclusion

Developing healthy credit card habits is crucial for maintaining a good credit score in India. While occasional late payments may happen, understanding their potential consequences and implementing strategies to avoid them empowers you to build a strong financial foundation. Remember, a good credit score opens doors to numerous financial opportunities, making it worthwhile to prioritize timely credit card payments and responsible credit management.