In today’s world, credit plays a vital role in our financial lives. From owning a home to building an emergency fund, credit cards and loans can be powerful tools. However, responsible credit usage is crucial to maintain a healthy credit score, which significantly impacts various aspects of your financial well-being. This blog delves into the concept of credit utilization and empowers you with a step-by-step guide to master it, ultimately improving your credit score and achieving your financial goals.

Understanding Credit Utilization

Credit utilization refers to the percentage of your available credit limit that you’re currently using. Imagine your credit card has a limit of ₹10,000. If you owe ₹2,500 on your card, your credit utilization ratio is 25% (2,500 / 10,000).

Why Credit Utilization Matters

Credit utilization is one of the most significant factors influencing your credit score, accounting for roughly 30% of your FICO score (used by many lenders in India). A healthy credit utilization ratio showcases your ability to manage credit responsibly, making you a more attractive borrower to lenders. Conversely, a high credit utilization ratio can negatively impact your score, potentially leading to:

- Higher interest rates: Lenders perceive individuals with high credit utilization as riskier borrowers, resulting in higher interest rates on loans and credit cards.

- Loan denials: A low credit score can make it challenging to secure future loans, hindering your ability to access financing for significant life events such as buying a car or a home.

- Difficulty renting an apartment: Landlords often consider credit scores during the application process, and a low score might put you at a disadvantage.

Recommended Credit Utilization Ratio

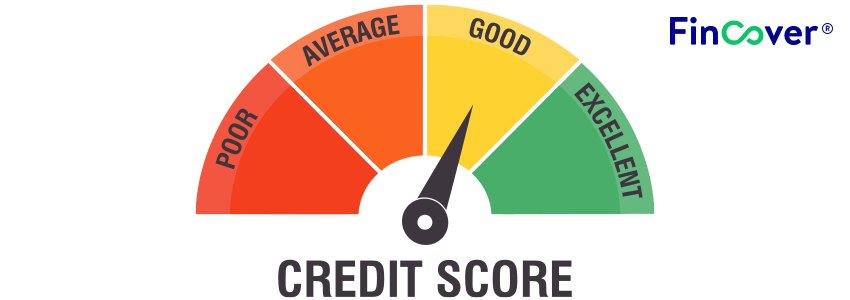

While there’s no single “magic number,” generally aiming for a credit utilization ratio below 30% is considered ideal for maintaining a good credit score. Here’s a breakdown:

- Below 30%: Excellent, this signifies responsible credit management.

- 30-50%: Good, but strive to keep it below 30% for optimal score improvement.

- 50-70%: Fair, consider reducing your credit usage to improve your score.

- Above 70%: Poor, significantly impacts your credit score and requires immediate action.

Step-by-Step Guide to Mastering Credit Utilization

1. Monitor Your Credit Utilization:

- Obtain your credit reports: You’re entitled to a free credit report from each credit bureau (CIBIL, Experian, Equifax) once a year. Reviewing your reports helps you understand your current credit utilization ratio and identify any errors that might be affecting your score.

- Track your credit card balances: Regularly check your credit card statements or online banking portal to stay updated on your outstanding balances and credit utilization ratio.

2. Pay Your Credit Card Bills on Time:

- Make at least the minimum payment: Timely payments significantly impact your credit score. Even a single missed payment can have lasting negative consequences.

- Consider paying more than the minimum: Ideally, strive to pay your credit card balance in full each month to avoid accumulating interest charges and keeping your credit utilization ratio low.

3. Strategize Your Credit Card Usage:

- Avoid maxing out your credit cards: Aim to keep your credit utilization below 30% for each individual card and your total credit limit across all cards.

- Utilize multiple credit cards strategically: While having multiple cards can increase your total credit limit and potentially lower your overall utilization ratio, avoid using them simultaneously to accumulate high balances.

4. Increase Your Credit Limit (if necessary):

- Contact your credit card issuer: If you consistently maintain a low credit utilization ratio and have a good payment history, consider contacting your credit card issuer to request a credit limit increase. This can improve your overall credit utilization ratio without actually increasing your spending. However, only request an increase if you’re confident you can manage the additional credit responsibly.

5. Utilize Alternatives to Credit Cards:

- Debit cards: Consider using debit cards for everyday purchases, ensuring you only spend what you have in your bank account, keeping your credit utilization completely at bay.

- Prepaid cards: If you’re struggling with managing credit card spending, consider using prepaid cards to limit your spending to the amount loaded onto the card.

Conclusion

By mastering credit utilization, you unlock the power to improve your credit score, gain access to better loan terms, and unlock greater financial freedom. Remember, a healthy credit score empowers you to navigate financial challenges with confidence and build a secure financial future. By following the step-by-step guide and incorporating the additional tips outlined in this blog, you can take control of your credit utilization and pave the way for a brighter financial future.