Understanding Credit Reports

A credit report is a detailed record of your credit history, maintained by credit bureaus like CIBIL. It includes information like:

- Borrowing history: Loans, credit cards, and other lines of credit you’ve availed of.

- Repayment behavior: Your track record of timely payments, missed payments, or defaults.

- Credit inquiries: Instances where lenders have checked your credit score for loan applications.

Why Errors Matter?

Errors in your credit report can have significant consequences. Here’s how:

- Loan Denials: Inaccurate information can lead to loan application rejections, hindering your ability to access credit when needed.

- Higher Interest Rates: A poor credit score due to errors can result in higher interest rates on loans, increasing your borrowing costs.

- Insurance Rates: Some insurance companies consider your credit score when calculating premiums. Errors can lead to higher insurance rates.

Identifying Errors

Regularly reviewing your credit report is crucial to catch errors early on. Here’s how you can access your report:

- Free Annual Report: You are entitled to a free credit report from CIBIL every year. You can request it through their website or mobile app.

- Paid Reports: You can purchase additional credit reports throughout the year for a nominal fee.

Common Errors and How to Spot Them

- Incorrect Personal Information: Check for typos or discrepancies in your name, address, date of birth, or PAN number.

- Inaccurate Account Information: Look for errors in credit accounts, including account types, outstanding balances, or payment history.

- Duplicate Accounts: Identify any accounts listed twice or accounts you don’t recognize.

- Errors from Closed Accounts: Ensure closed accounts are marked correctly and don’t reflect ongoing activity.

Dispute Resolution Process

Once you’ve identified an error, here’s what to do:

- Gather Evidence: Collect documents like bank statements, loan agreements, or closure letters that support your claim.

- Choose Your Method: You can initiate a dispute online through the CIBIL website, offline by submitting a dispute form, or by contacting CIBIL’s customer care.

- Clearly State the Error: Clearly explain the error in your report and provide supporting documentation.

- Follow Up: CIBIL will investigate the dispute and contact the lender or credit card company for verification. It typically takes 30 days to resolve the dispute.

CIBIL Dispute Resolution Portal

The CIBIL website offers a user-friendly online dispute resolution portal. Here’s how to use it:

- Visit the CIBIL website (https://www.cibil.com/).

- Login to your CIBIL account using your user ID and password.

- Go to the “Credit Report” section and click on “Dispute Resolution.”

- Select the disputed information and provide a clear explanation of the error.

- Upload any supporting documents you may have.

- Submit your dispute and track its progress online.

Additional Tips

- Dispute All Errors: Don’t hesitate to dispute any errors you find, however minor they may seem.

- Be Patient: The dispute resolution process can take time. Follow up periodically to check the status.

- Maintain Records: Keep copies of all communication with CIBIL and the credit bureau for future reference.

- Seek Professional Help: If you’re unsure about the process or need assistance, consider consulting a credit counselor or financial advisor.

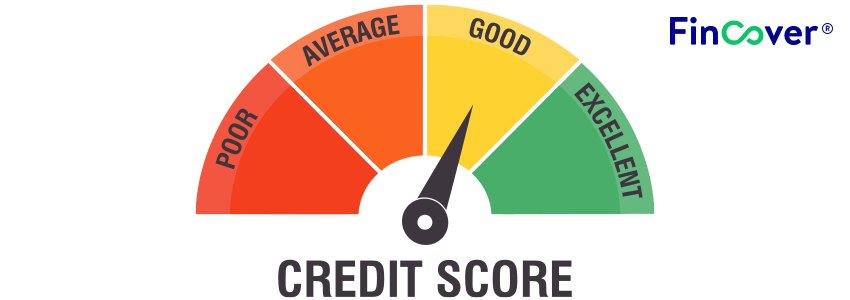

Maintaining a Healthy Credit Score is Key

While disputing and correcting errors is crucial, building and maintaining a good credit score is equally important. Here are some tips to achieve and maintain a healthy credit score:

- Pay Your Bills on Time: Timely payments are the single most significant factor influencing your credit score. Make sure to pay all your bills, including credit card bills, loans, utilities, and mobile phone bills, on or before the due date.

- Practice Responsible Borrowing: Maintain a healthy balance between your credit limit and credit utilization. Ideally, aim to keep your credit utilization below 30%.

- Manage Your Credit Mix: Having a diverse credit mix, including a mix of secured loans (e.g., car loans) and unsecured loans (e.g., credit cards), can positively impact your score. However, remember to only borrow what you can comfortably afford to repay.

- Limit Credit Inquiries: Excessive credit inquiries within a short period can negatively impact your score. Avoid applying for multiple loans or credit cards simultaneously unless necessary.

- Monitor Your Credit Report Regularly: Regularly review your credit report, not just annually. This allows you to identify and address any potential errors promptly.

Conclusion

By understanding how to identify and dispute errors in your credit report, and by adopting healthy credit habits, you can take control of your financial future. Remember, a clean and accurate credit report is essential for securing loans, obtaining desirable interest rates, and securing affordable insurance premiums. By following the steps outlined in this guide and exercising responsible financial practices, you can build a strong credit score and unlock a world of financial opportunities.