In today’s world, a good credit score acts as a key that unlocks doors to various financial opportunities. From securing loans at favorable interest rates to renting an apartment or potentially even landing your dream job, a strong credit score plays a crucial role in achieving your financial goals. But how do you build and maintain a healthy credit score? Worry not, as this blog equips you with 7 expert tips to improve your creditworthiness and unlock a brighter financial future.

Why Credit Score Matters

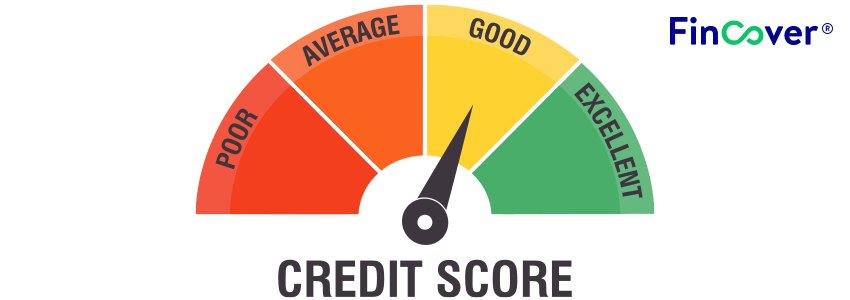

Your credit score, typically calculated by credit bureaus like CIBIL in India, is a numerical representation of your credit history and borrowing behavior. It reflects your ability to manage debt responsibly and is a key factor lenders consider when evaluating your loan applications. Here’s why your credit score matters:

- Loan approvals and interest rates: A good credit score significantly increases your chances of getting approved for loans, including mortgages, car loans, and personal loans. Additionally, it can qualify you for lower interest rates, saving you a substantial amount of money over the long run.

- Favorable credit card terms: Credit card issuers often offer better rewards programs, lower annual fees, and higher credit limits to individuals with good credit scores.

- Improved financial standing: A strong credit score signifies financial responsibility and can be advantageous in various situations like renting an apartment or applying for certain insurance policies.

7 Expert Tips to Improve Your Credit Score

1. Pay Your Bills on Time – Consistency is Key

- This is the single most significant factor influencing your credit score. Make all your debt payments, including credit card bills, loans, and utility bills, on or before the due date consistently. Even a single late payment can negatively impact your score for months.

- Set up automatic payments: Consider setting up automatic payments for your bills to avoid any accidental missed payments. This ensures timely payments and helps you maintain a good payment history.

2. Monitor Your Credit Reports Regularly – Be Proactive

- You are entitled to a free credit report from each credit bureau (CIBIL, Experian, Equifax) once a year. Regularly reviewing your reports helps you:

- Identify any errors: Inaccurate information on your report, such as incorrect balances or late payments, can negatively impact your score. If you find errors, dispute them promptly with the credit bureau and the creditor involved.

- Track your progress: Monitoring your credit reports allows you to track the impact of your efforts to improve your score over time.

3. Manage Your Credit Utilization Ratio – Wise Spending is Essential

- Your credit utilization ratio refers to the percentage of your available credit limit that you’re currently using. Aim to keep this ratio below 30% for optimal credit score improvement. For example, if your credit card limit is ₹10,000, maintain a balance below ₹3,000 to achieve a healthy utilization ratio.

- Avoid maxing out your credit cards: This can negatively impact your score and indicate risky borrowing behavior to lenders.

4. Build a Healthy Credit Mix – Diversification Matters

- While credit cards are a common credit tool, consider establishing a healthy mix of credit by including secured loans (e.g., car loans) in your credit history. This demonstrates responsible credit management and can potentially improve your score.

5. Limit Credit Inquiries – Be Selective

- Frequent credit inquiries for loans or credit cards can temporarily lower your credit score. Apply for new credit only when absolutely necessary and have a clear purpose for borrowing.

- Shop around for the best loan: Instead of applying to multiple lenders simultaneously, consider pre-qualification options that don’t impact your credit score. This allows you to compare different loan offers without jeopardizing your score.

6. Become an Authorized User on a Good Account (Optional)

- If you have a close family member or friend with a good credit history and responsible credit card management, consider becoming an authorized user on their account. Their positive payment behavior can improve your credit score over time. However, use this strategy cautiously and ensure the primary cardholder is aware and agrees to this arrangement.

7. Seek Professional Guidance (if needed)

- If you’re struggling to manage your credit or improve your score, consider consulting with a credit counselor or financial advisor. They can provide personalized guidance, develop a credit improvement plan, and offer valuable support